BOIR Reporting and Filing

Beneficial Ownership Information Report (BOIR)

As a business owner, you may be legally obligated to report specific information to the Financial Crimes Enforcement Network (FinCEN) regarding the individuals who have ownership or significant control over your company. This requirement is part of federal regulations aimed at increasing transparency and preventing financial crimes. Failure to accurately file the necessary information or neglecting to report altogether can result in substantial penalties, including monetary fines and potential legal consequences.

Who does it apply to?

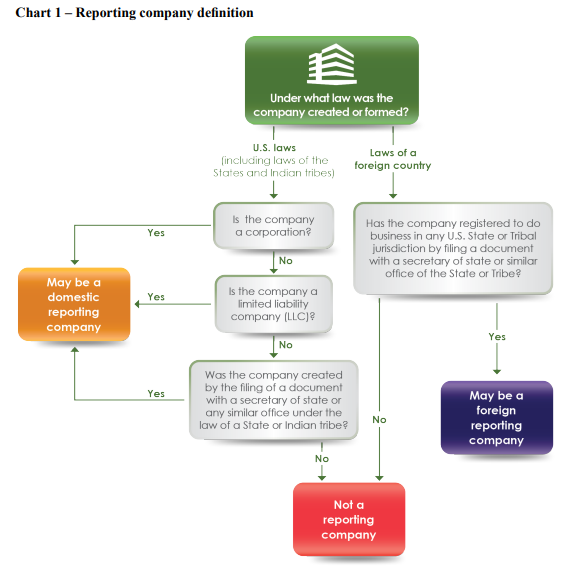

FinCEN uses 3 main requirements to determine who must report:

- A corporation, a limited liability company (LLC), or a group created in the US by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe with less than $5,000,000 in gross receipts or sales and less than 20 employees.

- A foreign company and was registered to do business in any U.S. state or Indian tribe by such a filing.

- Beneficial owners in the company who generally exercise “substantial control” over a reporting company or own 25% of the ownership interests.

Note: This DOES NOT apply to Sole Proprietorships.

Are you exempt from filing a BOIR?*

|

Exemption No. |

Exemption Short Title |

|---|---|

|

1 |

Securities reporting issuer |

|

2 |

Governmental authority |

|

3 |

Bank |

|

4 |

Credit union |

|

5 |

Depository institution holding company |

|

6 |

Money services business |

|

7 |

Broker or dealer in securities |

|

8 |

Securities exchange or clearing agency |

|

9 |

Other Exchange Act registered entity |

|

10 |

Investment company or investment adviser |

|

11 |

Venture capital fund adviser |

|

12 |

Insurance company |

|

13 |

State-licensed insurance producer |

|

14 |

Commodity Exchange Act registered entity |

|

15 |

Accounting firm |

|

16 |

Public utility |

|

17 |

Financial market utility |

|

18 |

Pooled investment vehicle |

|

19 |

Tax-exempt entity |

|

20 |

Entity assisting a tax-exempt entity |

|

21 |

Large operating company |

|

22 |

Subsidiary |

Are you a reporting company?

Why Choose Form Wise

Business Formation Solutions

More Reasons to Choose Form Wise

Our mission is to simplify business for you. Our experts are available by phone 7 days a week to answer your questions. Let us take care of the details so you can focus on what you do best.

Hours of Work

Clients Helped

Client Satisfaction

Frequently Asked Questions

What is BOIR?

BOIR stands for Beneficial Ownership Information Reporting. It’s a federal requirement under the Corporate Transparency Act (CTA) that mandates certain companies to report information about their beneficial owners to FinCEN (Financial Crimes Enforcement Network).

Who is considered a “beneficial owner”?

A beneficial owner is any individual who:

Directly or indirectly owns 25% or more of the company, OR

Exercises substantial control over the company’s operations or decisions.

Who is required to file a BOIR?

Most small businesses, corporations, LLCs, and similar entities formed or registered in the U.S. must file, unless they qualify for an exemption (such as large operating companies, certain regulated entities, or inactive entities).

When is the BOIR deadline?

Companies formed before January 1, 2024 must file by January 1, 2025.

Companies formed on or after January 1, 2024 must file within 90 days of creation or registration.

Starting January 1, 2025, new entities must file within 30 days.

What information must be reported?

You must report details about the company and each beneficial owner, including:

- Full legal name

- Date of birth

- Residential address

- An identifying number (like a driver’s license or passport)

- An image of the identifying document

How do I file the BOIR?

You can file the BOIR online directly through Form Wise Solutions. Please visit https://www.formwisesolutions.com/beneficial-owner-information-report-filing/

Can someone file BOIR on my behalf?

Yes, a third party such as Form Wose Solutions can file on your behalf—just make sure we have the correct information and authorization. Please visit https://www.formwisesolutions.com/beneficial-owner-information-report-filing/

Is the information reported to FinCEN made public?

No, the reported information is not publicly available. It will be stored securely and only accessible to authorized government agencies for law enforcement, national security, or regulatory purposes.