Is your Business Compliant?

Annual Filings and Reporting

Keeping up with annual filings is essential for maintaining your company’s good standing and avoiding penalties or dissolution. Whether you’re a startup or an established business, every state has its own set of requirements, deadlines, and fees—and missing them can cost you.

What Are Annual Filings?

Annual filings are mandatory documents that businesses must submit to state and federal agencies. These typically include:

Annual Reports

Updates on your company’s ownership, address, and registered agent.

Franchise Tax Reports

State fees required to legally operate in certain states.

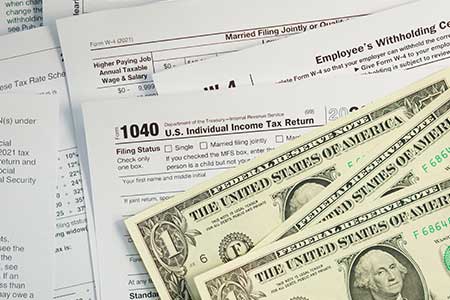

Federal & State Tax Returns

Early filings with the IRS and your state’s revenue department, even if no income was earned.

Why Choose Form Wise

Business Formation Solutions

More Reasons to Choose Form Wise

Our mission is to simplify business for you. Our experts are available by phone 7 days a week to answer your questions. Let us take care of the details so you can focus on what you do best.

Hours of Work

Clients Helped

Client Satisfaction

Frequently Asked Questions

What are annual filings?

Annual filings are required documents that businesses must submit to government agencies each year to maintain legal compliance and good standing. Common filings include annual reports, franchise tax returns, and income tax returns.

Who needs to file annual reports?

Most corporations, LLCs, and nonprofits are required to file annual or biennial reports with the state(s) where they are registered. The exact requirements depend on your business type and location.

What happens if I miss a filing deadline?

Missing a deadline can result in late fees, loss of good standing, or even administrative dissolution of your business. It can also impact your ability to secure financing or enter into contracts.

Is filing annual reports the same as filing taxes?

No. Annual reports are typically filed with the state and include business information updates. Tax filings (state and federal) are financial documents filed separately with tax authorities.

Do I need to file if my business had no activity?

Yes. Even if your business had no income or activity, you may still be required to file annual reports and tax returns to remain compliant.

How do I do my annual filings?

If you know the process, you can file yourself, but using a professional service like Form Wise Solutions ensures timely submissions, tracks state-specific deadlines, and reduces the risk of errors or missed filings. Start Filing Now… https://www.formwisesolutions.com/annual-filing/